In a turbulent year for the US electric vehicle market, the Tesla Cybertruck has performed particularly poorly. Elon Musk’s corner pickup saw the largest decline in sales of any electric vehicle in the U.S. in 2025 based on volume, according to an InsideEVs analysis of Cox Automotive data.

Tesla sold roughly 39,000 Cybertrucks during the truck’s first full year on the market in 2024, according to Cox estimates. Last year, sales fell by nearly half, with the company estimating that Americans would buy about 20,200 Turkish Cyber trucks in 2025. The shortage of about 19,000 units represents the largest drop in sales of any electric model on sale in America, including those that were partially canceled during the year.

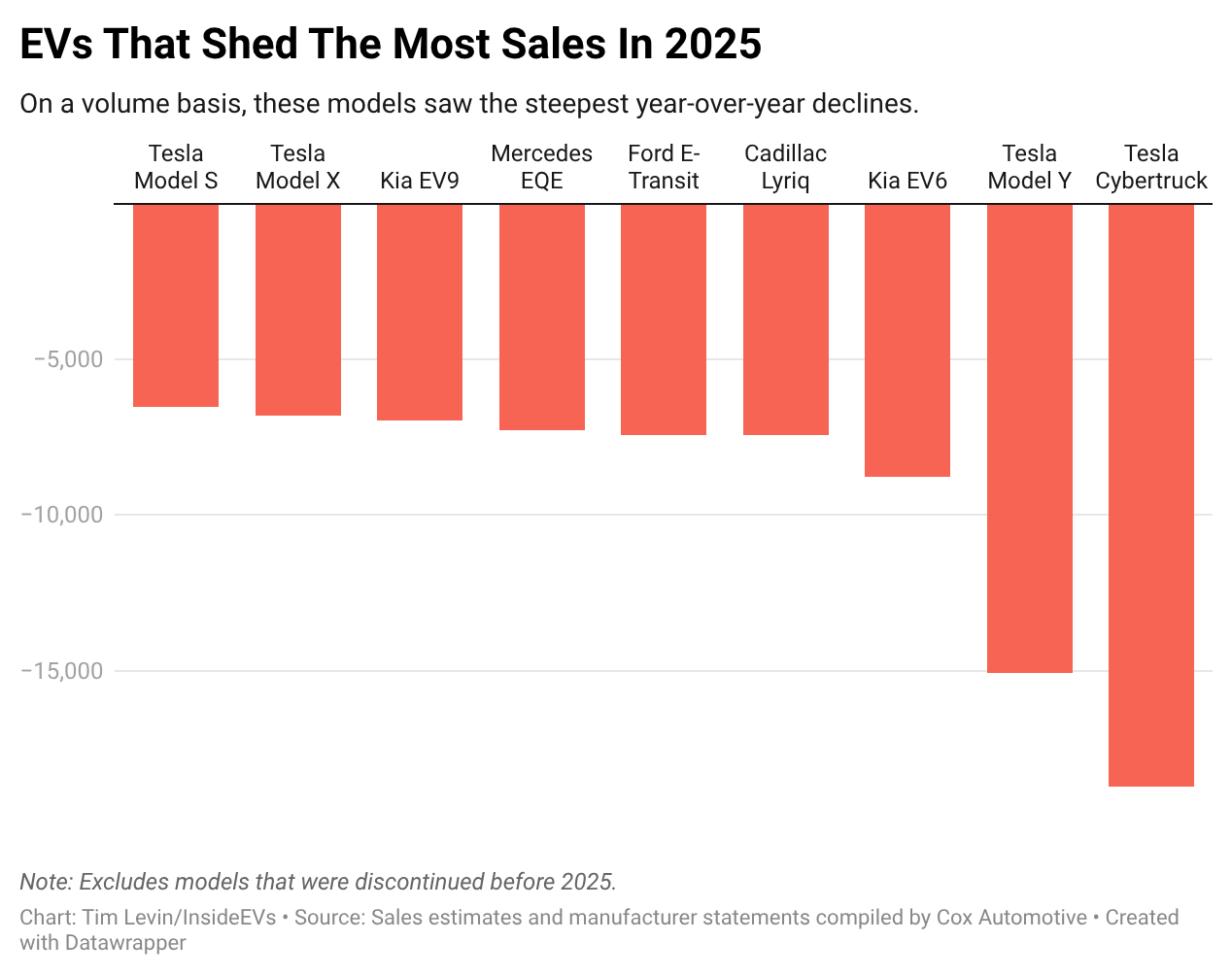

These electric vehicle models saw the largest decline in year-over-year sales volume in 2025.

Photography: Tim Levin/InsideEVs

Unlike most other manufacturers, Tesla does not break down deliveries by region or by individual model. So third party estimates are our best proxy for sales.

To be sure, the polarizing truck was partly a victim of its early success. And ended in 2024 as The most popular electric pickup in America With a strong margin, it attracts buyers with its unusual appearance and truly forward-thinking elements such as Steering by wire system. With only a few electric vehicles managing annual sales of more than 30,000 or 40,000 units in an increasingly crowded market, the Cybertruck has had to fall back further than most battery-powered models. Most models sell between 2,000 and 20,000 models per year.

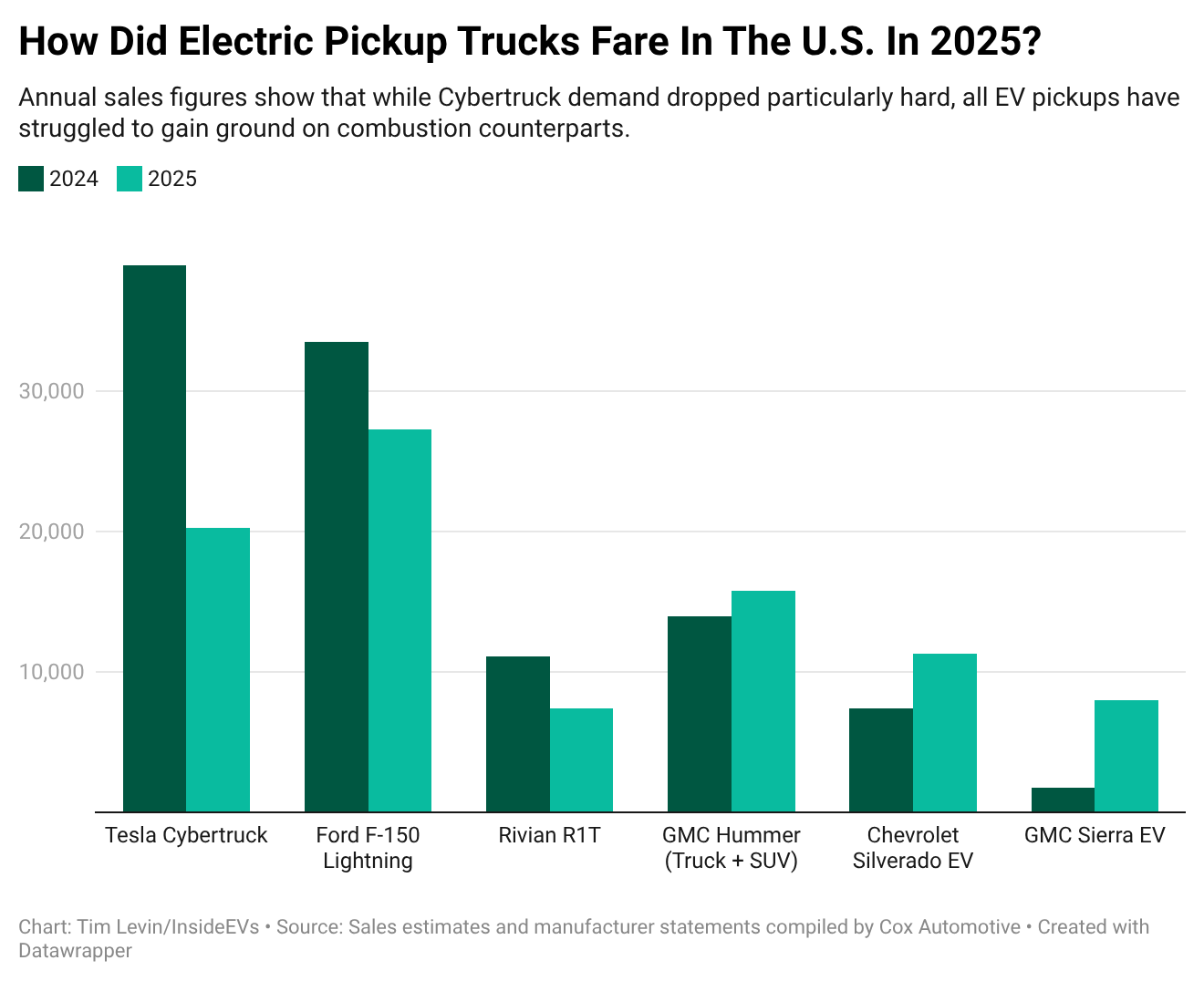

The Tesla Cybertruck has struggled with broader challenges facing electric pickup trucks in addition to brand issues at Tesla.

Photo by: InsideEVs

But it’s also clear that after the initial rush of buyers, demand for the Cybertruck — which Musk called Tesla’s best product ever — deteriorated quickly. The company says it has the capacity to produce more than 125,000 Cybertrucks annually at its Texas factory. It has set 250,000 trucks as a target in the past. All of this suggests that Tesla significantly overestimated consumer appetite for expensive stainless steel electric cars.

The Tesla truck wasn’t the only electric vehicle to see sales decline in a difficult year for America’s electric vehicle market.

Photo by: InsideEVs

It wasn’t the only model struggling to keep up in 2025 with the disappearance of key policies driving electric car sales, like the $7,500 clean car tax credit. Even before the political crisis, demand growth for electric vehicles was declining as enthusiastic early adopters gave way to mainstream buyers looking for more practical and affordable options. In 2025, more than two dozen electric vehicle models saw year-over-year sales declines, some steeper than others.

Kia EV6 sales decreased by 40%, from 21,715 units to 12,933 units. Cadillac delivered about 7,400 fewer Lyriq crossovers last year than the year before. Tesla Model Y sales were down about 15,000 units, but that was only a 4% decline for America’s most popular electric vehicle to date, Cox says. Sales of Ford’s E-Transit vans fell 59% to about 5,200 units.

But some models have bucked this trend. Chevrolet Equinox EV sales double to 57,945 units, making it a compact crossover America’s new favorite non-Tesla electric car. (The Equinox EV was only on sale for part of 2024.) Honda Prologue sales jumped nearly 19% to more than 39,000 units.

Newcomers that won’t be on the scene in 2024, like the Cadillac Optic, Hyundai Ioniq 9 and Jeep Wagoneer S-Also help balance out poor performers. U.S. sales of battery electric vehicles fell 2% to 1.28 million vehicles in 2025, according to a final Cox tally. The overall light vehicle market grew slightly.

The Cybertruck faced a particular set of challenges. Its “love it or hate it” approach has divided consumers since it was first unveiled in 2019. Musk’s association with the Trump administration and far-right issues more broadly has alienated liberals — a core group for buying electric cars — from the Tesla brand. For some, the Cybertruck has become more of a bold political statement than just a truck.

Electric pickup trucks have widely failed to keep up with the huge sales volumes of their gas-powered competitors.

Photography: Tim Levin/InsideEVs

The same was also dealt with Headwinds buffeting big electric pickup trucks Like the Ford F-150 Lightning and Chevrolet Silverado EV. Electric vehicle trucks have largely failed to take off in the United States due to the high cost of their large batteries as well as concerns about limited towing capacity.

The Lightning, once hailed as the pickup truck that would take the electric vehicle trend mainstream, It was canceled in December. Ram has scrapped its all-electric pickup plans in favor “Range Extended EV” version. A gas engine complements the battery. Although General Motors and Rivian sell electric pickup trucks in the United States, neither has been able to reach the sales volume achieved by American gas trucks.

Despite the Cybertruck’s stumbles and declining group-wide sales, Tesla finished 2025 as America’s top electric vehicle company — as it has done for many years. The automaker has sold roughly 590,000 vehicles in the U.S. according to Cox, giving it a 46% market share of the electric space. It proved more resilient to the collapse of after-tax credit sales in the fourth quarter as well. Cox says that in the last three months of 2025, Tesla’s share of electric vehicle sales has risen to 59%.

Contact the author: Tim.Levin@InsideEVs.com