- GM set a record for full-year electric vehicle sales in 2025, securing its position as the country’s second-largest electric vehicle seller.

- However, year-end BEV sales were not great.

- What goes up must come down: The fourth quarter showed a much larger decline than expected, as the industry was shaken by the expiration of federal tax credits.

If you zoom out enough, 2025 was like Excellent year for electric vehicles at GM. Electric vehicle sales were up overall, and in fact, it was the second best-selling manufacturer in America when it came to electric vehicles, bested only by Tesla. But we saw these two things coming from a mile away.

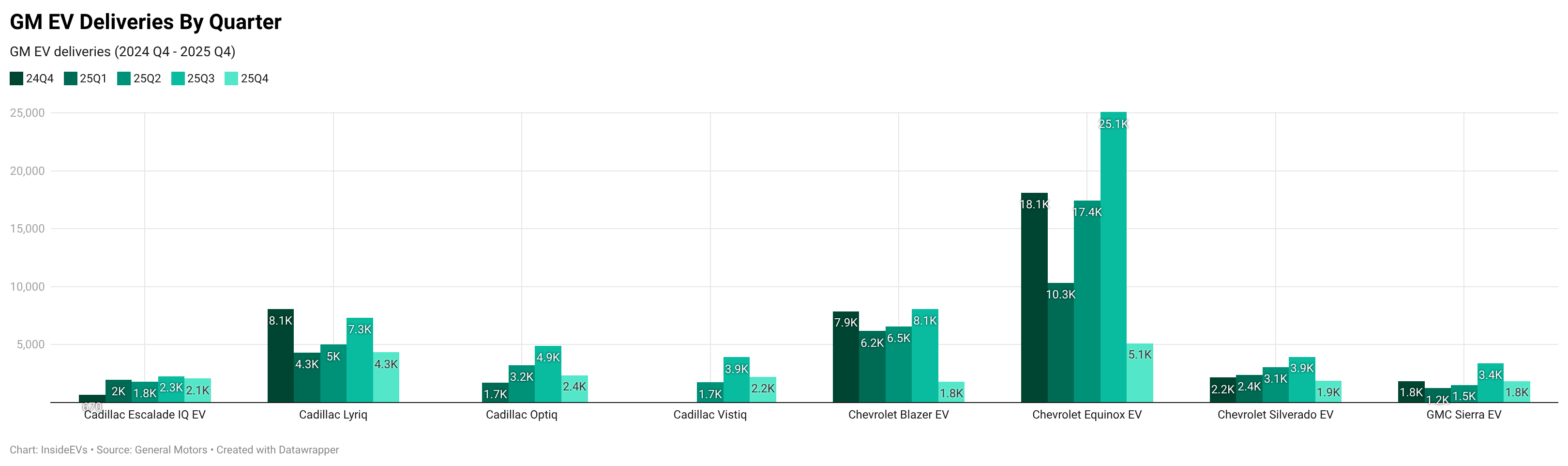

Zoom in on GM’s numbers a bit and you’ll see it’s not all good news. Its numbers fell off a cliff near the end of the year — a trend we’re starting to see across the EV industry as more companies report final delivery numbers for 2025. GM’s EV sales fell 43% year-over-year in the fourth quarter, a number made even more dramatic by the amount of growth GM showed through most of the year.

Photography: Cadillac/YouTube

The slowdown wasn’t supposed to happen so quickly. Both automakers and investors expected sales to decline. However, at least some electric vehicles were expected to continue boosting Q4 numbers. And yet, here we are: Not only did the fourth-quarter numbers cool off, but they essentially jumped into an ice bath even as most of GM’s gas-powered lineup continued to move with industry trends as if nothing had happened.

In fact, deliveries of every electric vehicle GM sells took a hit last quarter. For example, the Cadillac Lyriq was down more than 45% year over year in the fourth quarter while the Chevy Blazer EV was down nearly 80% from 2024.

Photo by: General Motors

GM knew this was coming. It warned the world that “the adoption of electric cars in the near term will be lower than planned” in 2017 Message to shareholders At the end of the third quarter, as a result, GM was working to “address excess capacity” to reduce EV losses in 2026.

Fingers point to declining demand thanks to regulatory changes, declining incentives and higher interest rates. Cautious consumers gave GM a great third quarter for its electric vehicles, but that was just anticipated demand to make impulsive purchases to avoid losing the EV tax credit — or basically one last buying bout before the inevitable EV sales hangover begins.

What’s interesting is that GM didn’t stop because it lacked electric vehicles. In fact, GM has been one of the best-selling automakers when it comes to affordable battery-powered options. But GM quickly realized that adoption was not universal across all segments. The crossover and luxury markets adapted quickly while full-size trucks rarely converted at all (Ford learned a similar lesson).

GM’s strategy is not broken. Early adopters have emerged and major buyers have lined up cautiously in 2025. Now the market is adapting to changing conditions, and as we have seen largely with Cash for Clunkersit is very likely that the decline in EV demand in the fourth quarter was exacerbated by the discontinuation of the EV tax credit and pushed sales into the third quarter.

If nothing else, 2025 will prove that building electric vehicles at scale is no longer a problem for major automakers. The real challenge? Persuading millions of regular buyers to switch to electricity without government money on the cap.